XBRL reduces mechanical data entry, eliminates entry errors, encourages more analysis of data, facilitates comparisons against external data, and provides greater transparency. XBRL is an important tool in allowing all stakeholders to more efficiently share and analyze information. These subsequently affect the quality and quantity of corporate reporting data.

A number of government bodies have already adopted XBRL. The HM Revenue & Customs (HMRC) in the UK has mandated the filing of Corporation Tax Returns in XBRL electronic format for accounting periods ending after 31 March 2010. HMRC have stated that if organisations are unable to file both Company Tax Returns and company accounts in the prescribed format then HMRC will simply reject the submission.

The European Commission is presently looking into using XML for standardised reporting of emissions in the EU Emission Trading System (ETS). It is also officially supported by the European Parliament as well as the governments of the Netherlands, Australia, Singapore, Japan, India, and China.

In addition to these examples, now that the United States Securities and Exchange Commission (SEC) mandates the use of XBRL, stock exchanges around the world have begun to use it. Other common functions in countries that use XBRL include banking regulators, regulators of stock exchanges and securities, revenue reporting and tax-filing agencies, and national statistical agencies.

In summary, some of specific benefits that are considered to be achievable by electronic standardization of reporting:

- Accuracy, quality, and data integrity: XBRL will help companies reduce the number of errors in the information they report.

- Interoperability of systems: existing GHG accounting software does not easily exchange data. By standardizing concepts and reports (outputs), companies can refer to a common standard to transform their data so that it easily transferable between systems.

- Timeliness: increasing pressure from clients, governments and investors will require more frequent reporting of inventory data in the future. XBRL allows companies to report inventory data with a frequency they can specify and make data available more rapidly because the time spent rekeying and verifying is decreased.

- Transparency and Comparability: CDP currently holds the largest database of corporate climate change data. XBRL is a global standard based on XML that allows for the provision of meaning by defining and making available to all the data and metadata definitions.

- Value-add: XBRL allows users to select specific data in order to customize reports and provide tailored information to end-users such as investors, auditors and analysts.

- Decrease costs: your stakeholders use CDP’s climate change data. The lack of a common standard considerably increases the cost of transforming and analyzing data. E.g. error and consistency checking. Furthermore, value chain reporting of GHG data will become increasingly important to you. Helping to drive adoption of the CCRF XBRL Taxonomy for climate change reporting is a long term vision and will streamline supply chain reporting.

CDP, CDSB and XBRL – How it Fits Together

The XBRL Climate Change Reporting Taxonomy (CCRT) is a joint project of the CDP and the Climate Standards Disclosure Board (CDSB). Through the Climate Change Reporting Framework, CDSB provides guidance and strategy for reporting climate change in mainstream corporate reports. CDP provides the data platform and process through which to collect information for this. These collaborative parties are working to provide a single Climate Change Reporting Taxonomy that can be used both for sustainability information and for mainstream corporate filings. Simply speaking, XBRL can be used by your corporate social responsibility or sustainability teams to disclose to CDP and as effectively by the office the Chief Financial Officer for mainstream filings.

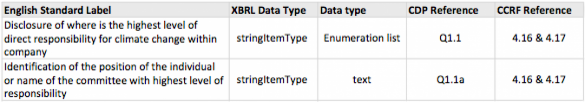

An XBRL taxonomy is a dictionary of reportable concepts, organized in a standard, formal way by means of tags, references and links between concepts. In the case of the Climate Change Reporting Taxonomy, reporting concepts are organized in such a way that responding to the CDP questionnaire or producing a mainstream report including climate change information (e.g. by following the principle and criteria of the Climate Change Reporting Framework) can all be done using the same concepts and reporting structures. Furthermore, we are working hard in order to make the taxonomy integrated with other reporting taxonomies, such as IFRS or GRI.

By tagging and relating the concepts, both preparers and users of information know exactly what information they are providing/analyzing. Additionally, data is shared in a format where all elements necessary to understand one concept, will be identified and presented together.

To get involved in the development or testing phases of this project please contact us at .