The EU has published the new Corporate Sustainability Reporting Directive (CSDR) which revises the Non-Financial Reporting Directive (NFRD). CDSB is working closely with EU Institutions and Member States to ensure a proper review of the Directive across the European Union is achieved using international reference points such as the CDSB Framework for reporting environmental information.

Read CDSB's key proposals to ensure that the new Corporate Sustainability Reporting Directive is fit for purpose.

The CSRD proposal for a directive amends the Accounting Directive 2013/34/EU as well as the Transparency Directive 2004/109/EC and the Audit Regulation No 537/2014 and the Audit Directive 2006/43/EC. It requires around 49,000 companies across Europe to disclose in their management report information on business model and strategy, policies, risks, targets and due diligence as regards environmental matters, social and employee aspects, respect for human rights, anticorruption and bribery issues, and diversity with regard to gender and other aspects such as, age, or educational and professional backgrounds in their board of directors. CDSB welcomes the review of the Directive as a significant step to increase corporate transparency, relevance, consistency and comparability of sustainability information for the large and listed undertakings falling under the scope.

Although some aspects of the Directive can still be improved, CDSB believes that the legislation should serve as a minimum set of requirements across the Union.

CDSB will work at the EU level to improve further the Directive, to clarify its requirements and incorporate recent developments, such as the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

At the Member State level, CDSB will continue building capacity and providing guidance to companies to support the reporting of decision-useful sustainability information to financial markets.

Areas for improvement

- Make reporting information material for enterprise value creation in the management report mandatory;

- Increase the current scope to include large undertakings with >250 employees, as already defined in Accounting Directive; and

- Strenghen linkages between non-financial and financial information by ensuring the implementation of the TCFD Recommendations, including information on the financial impacts of climate on the business.

Follow the link to find out more about key proposals the to the CSRD.

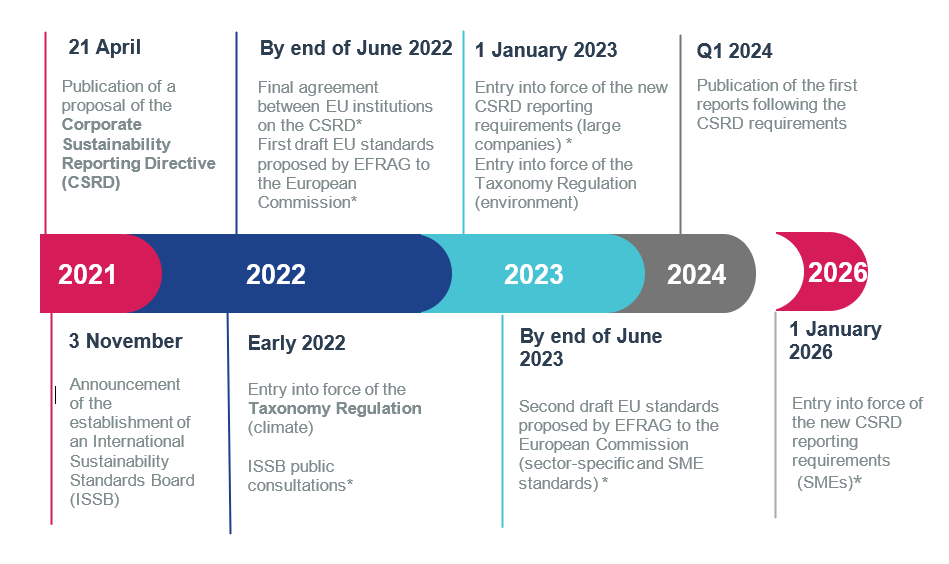

Expected Timeline

The Sustainability reporting policy in Europe is moving at an unprecedented pace, based on the review of the Non-Financial Reporting Directive (NFRD by the Corporate Sustainability Reporting Directive (CSRD) and the development of European sustainability reporting standards.

Follow the link to find out more about the expected timeline and legislative and preparatory work on EU sustainability reporting standards.

An opportunity for the European economy

The next update to the CSRD must provide the catalyst to push companies to increase their disclosure on environmental and climate risks and opportunities and ensure that investors are fully informed about the sustainability of their investments. A light touch to the existing Directive simply won’t do and certainly won’t channel the extra €260 billion needed in annual investments to deliver on the EU’s 2030 climate and energy targets.

The suggestions above are a snapshot of CDSB's position. We welcome the opportunity to discuss the position to the CSRD with you.

Read our full proposals to the CSRD.

Get in touch with Michael Zimonyi, the Director of Policy and External Affairs and Axelle Blanchard, Policy Manager here at CDSB to discuss in more detail: michael.zimonyi@cdsb.net, axelle.blanchard@cdsb.net

With the contribution of the LIFE Programme of the European Union

The content of this page is the sole responsibility of the author and can under no circumstances be regarded as reflecting the position of the European Union