We welcome the release of the London Stock Exchange ESG guidance, a step forward in the adoption of the TCFD recommendations

The recommendations put forward by the Financial Stability Board’s Task Force for Climate-related Financial Disclosures (TCFD) received significant backing in the London Stock Exchange group’s (LSEG) Environmental, Social and Governance reporting guide, released last week.

The exchange announced the release of ESG guidance last year – alongside 20 other stock exchanges globally – but delayed it to incorporate the recommendations of the TCFD, which were published in December 2016.

Why does it matter? We are talking about the third largest stock exchange in the world, and the first regulatory authority, endorsing the TCFD recommendations less than two months after their release. As FTSE Russell’s CEO Mark Makepeace’s put it - “ESG is no longer an ethical issue, it’s a business issue.”

Given that stock exchanges are essentially facilitators for transactions between issuers and investors, the guidelines aim to improve this relationship by providing better information upon which these transactions are made. By calling on investor relations and sustainability departments to align, the LSEG is pushing for better quality, consistent and comparable data to be reported and used effectively.

The guidance

The guidance opens on a critical reality check. The exchange quotes a study by Principles for Responsible Investment (PRI), which shows that “Chief Executives tend to overestimate their success in communicating with investors”, as “over a third of companies believed they were able to quantify the business value of sustainability initiatives accurately, yet only 7% of investors agreed.”

Therefore, the guidelines make it clear that the reported environmental and sustainability information users are investors, and the information disclosed has to be tailored to investors’ needs, enabling them to make informed capital allocation decisions.

Having this clear audience gives greater value to the direction the guidelines provide. In our experience, organisations and institutions providing ESG guidelines tend to avoid defining the audience for a particular report, targeting too many groups at the same time.

Consumers, investors and shareholders speak different languages and have different interests: it is unrealistic to expect them all to be interested in the exact same content presented in the same way. As liasons of issuers and investors, the exchange has honed in on how to make communication between these parties useful and successful.

As the London Stock Exchange is the home to FTSE Russell – a well-established and widely used index provider – we notice the presence of the experienced data user and and analyst voice presenting real life issues. Not having a complete data set, having targeted content for specific audiences, are some of the demands that investors have been putting forwards over the past years.

Mapping the reporting space

Note that many past ESG guidelines share a common mistake. They limit themselves to listing existing reporting frameworks and initiatives, rather than specifying the ones that are right for the guideline’s intended purpose and audience.

In this case, the LSEG explores some of the current initiatives that investors are looking at, from the SDGs to the TCFD, as well as the most used frameworks for ESG reporting – including the CDSB Framework for environmental and natural capital reporting.

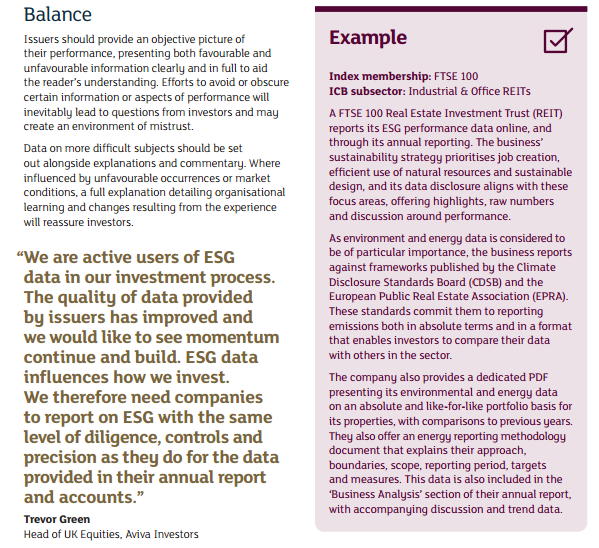

The exchange goes further by adding best practice examples. Throughout the different sections, we can see how issuing companies of different sectors report on ESG matters, what they did to make information decision-useful, and how this makes them stand out among their peers.

Source: Revealing the full picture: Your guide to ESG reporting

The release of these guidelines is particularly significant because of their alignment with the TCFD recommendations on climate disclosure and climate risk, which are aimed at scaling up the adoption of voluntary requirements for climate reporting across the G20.

Better quality information

Both the recommendations and the LSEG guidance deal with an important issue in the reporting space: climate, environmental and sustainability reporting need to go beyond reporting data and numbers. Reporting has to relate back to the core business model and strategy, the impact on a business’ financial performance – in short, it has to be embedded in the core financial thinking.

What does it mean to report better quality information to investors in practice? The Exchange outlines the main principles that issuers should be considering – accurate, timely, aligned with the issuer’s fiscal year and business ownership model and based on consistent global standards to facilitate comparability. These principles align with both the Task Force recommendations and the CDSB Framework for environmental reporting.

We believe that aligning and making the connection between financial and non-financial information in mainstream reports should be the ultimate goal to ensure better quality information is delivered to financial markets. Improving ESG reporting benefits everyone – companies, investors, markets, consumers. The journey has begun and we are heading in the right direction. The time is right for you to get on board.