Today the Coalition Group (of which CDSB is a member), together with the Financial Reporting Council (FRC), launched the Wates Corporate Governance Principles for Large Private Companies.

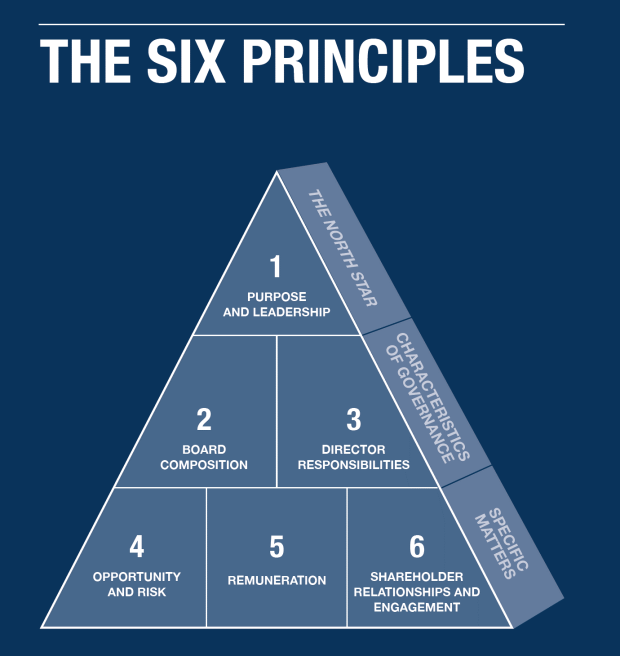

The Wates Principles for corporate governance focus on these six areas:

1. Purpose and Leadership

2. Board Composition

3. Director Responsibilities

4. Opportunity and Risk

5. Remuneration

6. Stakeholder relationships and engagement

These principles enable companies to clarify the application and relevance of their corporate governance arrangements. An ‘apply and explain’ approach can be used when referring to the principles as appropriate for the organisation and their circumstances. They should then be able to explain in their own words how they have addressed them in their governance practices.

CDSB notes in particular Principle 4 on Risk and Opportunity, which states that a company’s ‘board should promote the long-term sustainable success of the company by identifying opportunities to create and preserve value, and establishing oversight for the identification and mitigation of risks.’ The guidance following this Fourth Principle includes establishing an internal control framework with clear responsibilities including: agreeing an approach to reporting (e.g. frequency and points at which decisions are made/escalated); determining principal risks and the company’s ‘risk appetite’; agreeing on timeframe and management of these risks; identifying internal and external risk factors; agreeing a monitoring and review process and developing risk management systems.

The guidance specifically elaborates that risk management systems should clarify emerging and established risks in a way that enables the board to make ‘informed and robust decisions, including those associated with material environmental, social and governance matters, such as climate change, workforce relationships, supply chains, and ethical considerations.’ CDSB wishes to further emphasise the presentation of climate change as a material risk, and how this is central to the recommendations on climate-related financial disclosures made by the Financial Stability Board’s Taskforce on Climate-related Financial Disclosures (TCFD).

CDSB Technical Director and member of the Coalition Group Nadine Robinson notes that the launch of the Wates Principles "presents an excellent opportunity for large private companies to consider the Task Force on Climate-related Financial Disclosures as part of good corporate governance.”

CDSB’s framework promotes corporate reporting of environmental and climate information in line with the TCFD, including disclosing the risks and opportunities of climate-related and environmental matters on companies. The Wates Principles document also includes useful guidance for considering these and other material ESG opportunities and risks.

The Coalition Group, including CDSB and supported by the FRC, will continue to meet and work to promote the Wates Principles. It will identify good practices and make any necessary adjustments that may be required after monitoring how reporting against the Principles develops.

Chairman James Wates CBE states in the Foreword to the Principles that: “… good corporate governance is not about box-ticking. If we are to increase the public’s confidence in business, then surely, … [this] can only be achieved if companies think seriously about why they exist, how they deliver on their purpose, and then explain – in their own words – how they go about implementing the Wates Principles. That is the sort of transparency that can build the trust of stakeholders and the general public.”