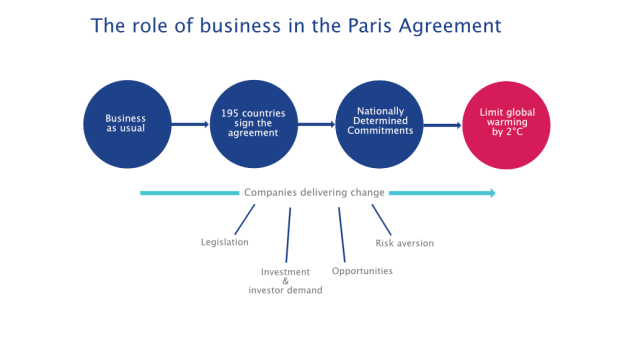

With the historic Paris Agreement signed by the world's governments, its ability to deliver rests in the hands of the market.

To meet the 2°C or lower target outlined by the agreement, governments will need the support of additional actors. The role of businesses will be crucial to implement changes and they have a unique opportunity to lead the way. With increased legislative demand, political pressure, as well as investor demands, companies are starting to respond to a changing landscape.

The Paris agreement is different from any other because companies, or non-state actors, were advocates in favour of a strong deal. At COP 21, businesses made bold commitments including:

- Rallying behind carbon pricing

- Setting science-based emission reduction targets

- Responsible corporate engagement in policy

- Report climate change information in mainstream reports as a fiduciary duty

- Procuring 100% of electricity from renewable sources

Businesses will play a major part in the success of the agreement as they demonstrate their fiduciary duty to manage and report on climate change in their mainstream report by supporting and driving the transition to a low-carbon economy.

This fact that business sees the deal as an opportunity has been a contributing factor to the success of the negotiations in Paris and now it is up to Governments to create an environment where companies, and the financial market at large, can be part of the solution to addressing climate change.

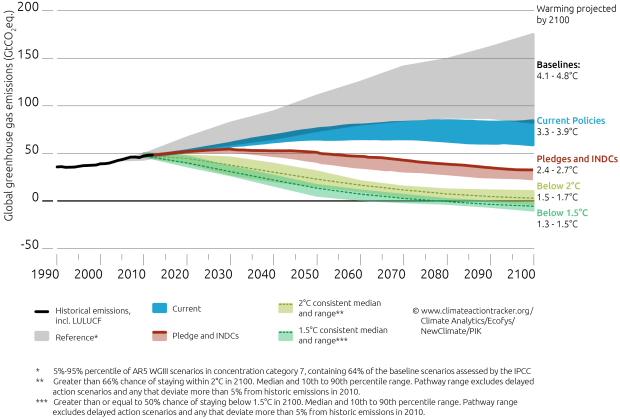

Response to the NDCs

The Intended Nationally Defined Commitments (INDCs) pledged in Paris, are now transitioning into NDCs, where the intentions are evolving into actions. Unlike previous agreements, we are witnessing quicker action, with four small island states (Fiji, Marshall Islands, Palau, Maldives) being the first to ratify the agreement, with China and USA promising to sign on the 22nd. There is a building optimism that this quick response from Governments will lead to fast action and ultimately a solution.

Source: Carbon Action Tracker

It is clear that NDCs alone are not enough to limit warming to 2°C. Therefore, in order to extend and progress the goals to an appropriate level, governments will need the co-operation of businesses. The likelihood of additional and stricter policies imposed on businesses can either be viewed as business risks or opportunities, depending on the outlook and responsiveness of the company.

We expect more legislation requiring companies to disclose their climate-related information to emerge. Some countries, like South Africa and the UK, have already implemented mandatory reporting for listed companies, whilst others like the Singapore Stock Exchange are developing similar models. We have supported these developments by providing climate change-related corporate reporting requirements for adoption by stock exchanges. Companies that have already integrated non-financial information into their annual reports will experience little changes if these requirements are made compulsory. This proactive rather than reactive response demonstrates that these companies are ready to support the implementation of the NDCs and drive change.

Investor interest in ESG

Readers of this blog will be well aware that investors are becoming increasingly concerned with ESG factors. Even more evidence is showing that companies who have focused on sustainability within their value chain create a stronger long-term investment opportunity.

This presents an opportunity for businesses to attract investment through focusing on ESG matters that align with these investor demands while at the same time contributing to the NDCs and reducing climate risk. It is a win-win situation that companies can respond to.

To present a brief picture of GHG emission disclosures within annual reports, our review of FTSE 350 found that 90% of companies disclosed their total annual GHG emissions. Those companies that disclosed omitted emission sources provide an explanation of which 44% cited materiality as the main reason. While 79% disclosed the breakdown of Scope 1 and 2 GHG emissions only 26% of companies disclosed their Scope 3 emissions.

Launched at COP 21, the Financial Stability Board recognised the importance for disclosure and therefore set up the Task Force on Climate-related Financial Disclosure (TCFD), calling for consistent and comparable information. Implementing the CDSB Framework can help organisations meet this goal while aligning it with information in their mainstream annual report presented to investors.

In the four months since the agreement was made, changes are already happening. Countries are starting to ratify their commitments into legislation and companies are recognising there is a business opportunity. This is an exciting time for companies to work in tandem with governments to shape the future of business in a way that will create a climate resilient and sustainable future. We will continue to support companies, investors and businesses through advancing mainstream corporate reporting to drive the capital that is needed to deliver this future.